Paytm is one of the largest e-commerce and e-payment portal that was launched in the year 2010. The name of the brand itself means “Payment Through Mobile.”The brand comprises a payment gateway and a wallet and also provides other facilitations like online shopping etc. Paytm has earned a lot of popularity because of its promotions of cashless transactions.

What is Paytm Wallet?

The Paytm app has a virtual purse called the Paytm Wallet. The account holder can fill in money to it using a debit card and credit card, or through net banking. The amount of money accumulated in the wallet can be used for the purchase of other products and services including phone bill, electricity bill, DTH recharge, gas, metro rides, water, and college fees.

How To Add Money To The Paytm Wallet Using A Credit Card?

Account Holders can add money to their Paytm Wallet in two simple methods using their credit cards- through the website or the app. All they need to do is follow the step listed below:

- On the Paytm website:

- First of all, one has to visit www.paytm.com and log into their Paytm account using their registered email id or phone number.

- A page with lot of options will appear and one has to select “Add Money.”

- They will need to select the mode of adding money from the list of options that include credit/debit cards, net banking, and IMPS and type in the amount of money they want to add.

- On selecting the option of “Credit Card,” they will see a secured payment page opening and they have to fill in their card details.

- They will need to fill in details like card number, name on the card, validity, and CVV number.

- The following details need to be filled in like details of the credit card and it will appear on screen from the second transaction they make. However, they will need to enter their CVV number each time they use the credit card even after saving its details to maintain the security of the gateway. This method ensures a faster payment.

- Once they finish entering the required details of their credit card, they will need to click on the “Submit” tab for the transaction to proceed. Once the transaction is completed, they will be redirected to the homepage of their Paytm account with the transferred amount in their Paytm Wallet.

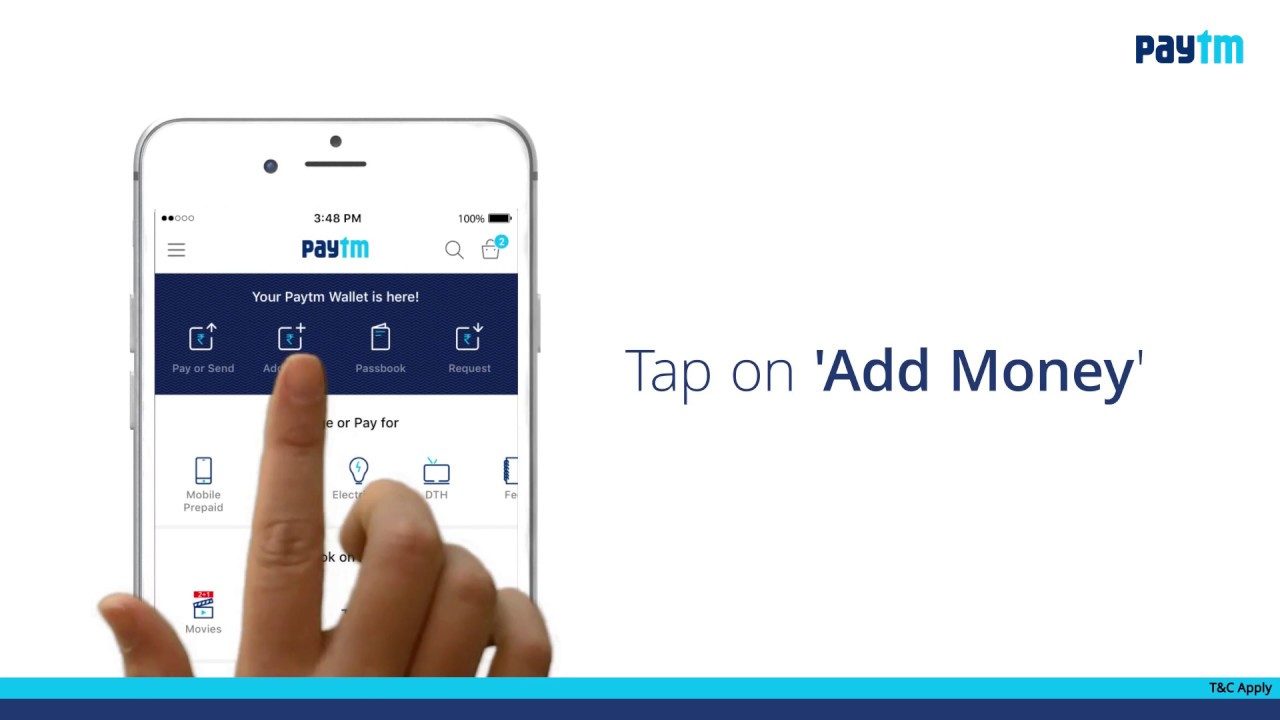

- On the Paytm app:

- The account holder, first of all, has to open the app on their phone, and then he has to click on the “Add Money” option that appears on the topmost strip on the homepage.

- Once it’s clicked, they will be asked to select their mode of payment from debit/credit card, net banking, and IMPS.

- On selecting a credit card, they will be directed to a secure payment gateway on which they will need to fill in their card details like card number, name on the card, validity, and CVV number.

- The account holder will be provided the option to save the details of the credit card to make payments faster from their second transaction. However, they will still need to enter their CVV number every time they try to make a transaction for security purposes.

- Once the details have been entered, they will need to click on the “Submit” tab after which the money will be added to their Paytm Wallet.

Transfer Charges On Adding Money To The Paytm Wallet Using A Credit Card

Account Holders don’t need to pay any charge on using a credit card to add below Rs 10,000 to their Paytm Wallet. In case the amount exceeds Rs 10,000 one will be levied a charge of 1.7% of the amount loaded through credit card on the wallet. This directive came into being in January 2020.