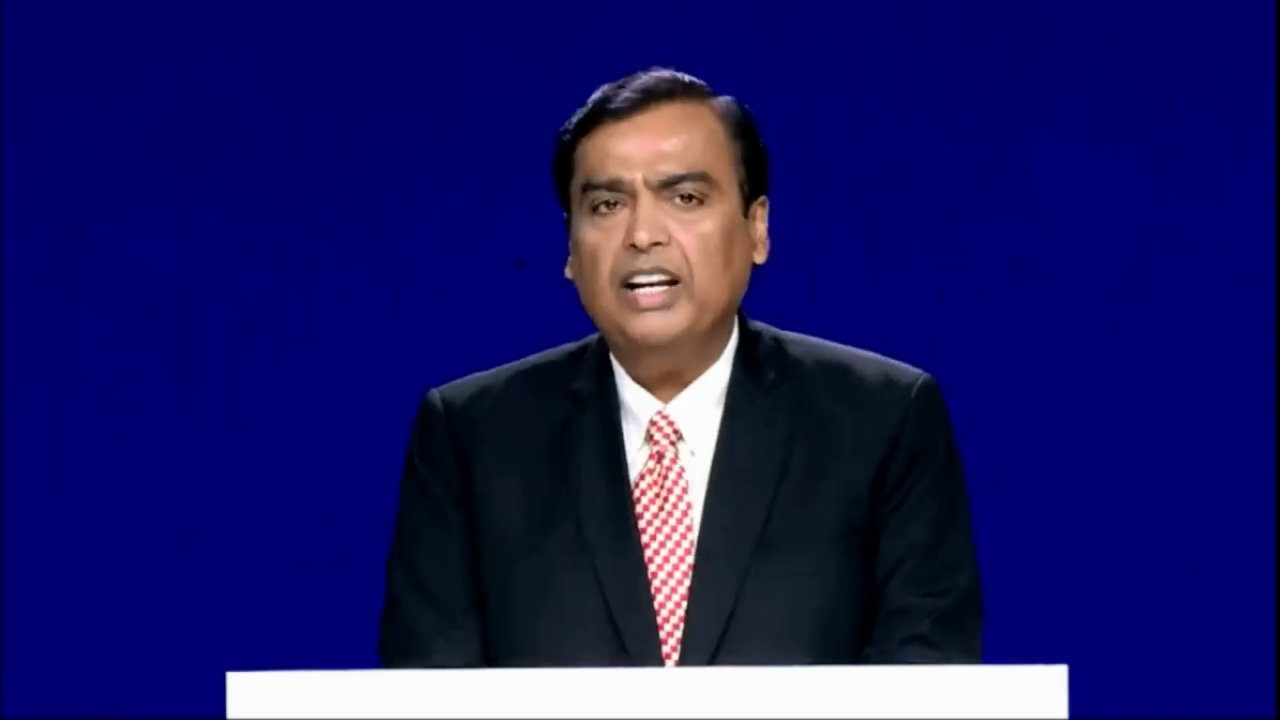

The top priority for the country’s most successful and most profitable business establishment is to deleverage. Reliance Industries Limited (RIL) chairman Mukesh Ambani’s focus of the group’s deleveraging plans during the company’s AGM, has got the analysts talking. In recent quarters, the company’s growth trajectory has largely remained unimpacted by the external economic factors. The profits have remained robust. The group’s new venture Jio has continued to attract more customers than any other player in the telecom space.

Team Newsd spoke to RIL insiders to find, why this sudden rush to deleverage then? A senior RIL official told Newsd that this has to do with a recent meeting of bankers, where debt exposure to large corporates was reviewed. Post this meeting, various bank consortiums had met their respective clients with the intent of stock-taking.

Inside RIL, the general feeling is that banks are not willing to offer any benefit of doubt to business for factors beyond their control. “Today, we are doing well. Our bottom line is robust. But there can be turned in macro-economic factors which we may go beyond control. The general sense we are getting is that if it does happen, we cannot expect anyone, from banks to government, to be sympathetic. So, it’s better to deleverage when the going is good,” a senior-level official in RIL said.

According to top company officials, Aramco acquiring an equity position in RIL is the first in a series of activities planned at achieving a complete deleverage in the near future. More stake stale to Aramco can also not be ruled out. Earlier this month, the Arab oil major acquired a 20% stake in RIL’s oil business for approximately Rs 1 lakh crore. As per company sources, the maximum proceeds of the deal will be utilized for debt settlements.

Cafe Coffee Day shares drop nearly 20% after owner of the chain VG Siddhartha goes missing

Banking circles are not very comfortable with RIL’s deleverage rush. According to rough estimates, the company’s lender consortium generates more than Rs 35,000 cr on account of interest payments by RIL. “The country’s biggest borrower, with no history of default and an extremely healthy balance sheets, does not have faith that they will not get a benefit of doubt, in case something goes wrong. And this will directly impact the recurring income of banks. It’s a serious concern, and the government must make efforts to allay such fears of industrialists,” said a billionaire industrialist.