Income inequality in India has increaed since deregulation started in the 1980s, with the top 10 per cent of earners accounting for 55 per cent of the national wealth in 2016, according to a global research report released on Wednesday. The India-specific finding of the ‘World Inequality Report 2018’ authored,[Read More…]

Tag: Economy

Political Circus: BJP needs to rein in the Hindutva hotheads

The rise in the growth rate to the moderately satisfactory 6.3 per cent from the depressingly low 5.7 per cent is good news for the Bharatiya Janata Party (BJP) at a time when the Prime Minister reminded the audience at a function organised by a media house about former President[Read More…]

India needs overall energy policy, gas must in GST: Pradhan

Renewing the call for bringing natural gas under the GST regime, Petroleum Minister Dharmendra Pradhan on Tuesday said the country needs an overarching policy covering various energy verticals in order to achieve self-sufficiency and security in this critical sector. Defending the government’s target of doubling Indian oil refinery capacity to[Read More…]

Telangana bags best performing state award in economy, cleanliness

Telangana has bagged the best performing large state award in economy category as well as the cleanliness and environment category at the annual ‘India Today’ State of the States rankings this year. The awards were received on behalf of the state by the Municipal Administration and Urban Development Minister K.T.Rama[Read More…]

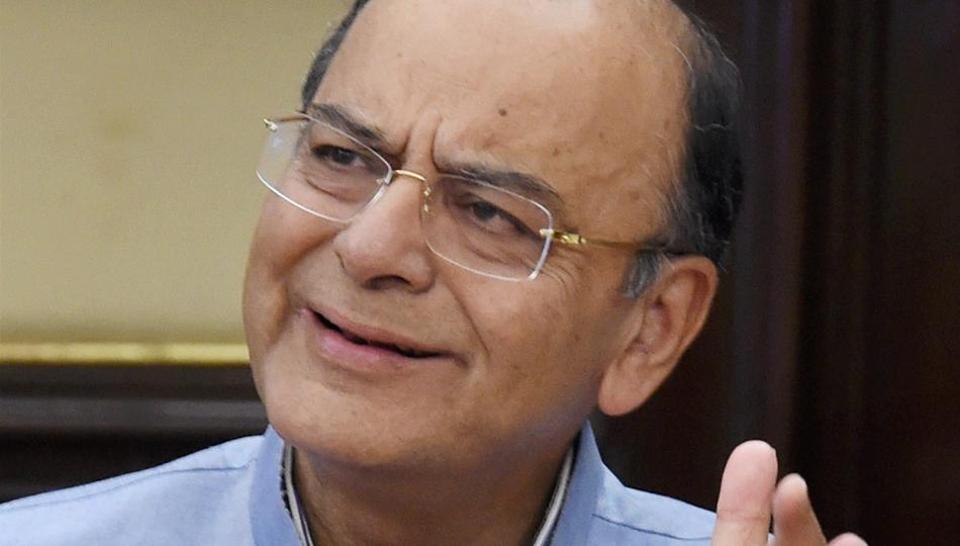

Entrepreneurship will be strength of Indian economy: Jaitley

Union Finance Minister Arun Jaitley on Thursday said entrepreneurship is going to be a strength of the Indian economy as jobs in the public as well as organised private sectors are not enough for the country’s huge working population. “The strength of the Indian economy is going to be entrepreneurship.[Read More…]

Are those observing black day in favour of black money, asks Sitharaman

Union Defence Minister Nirmala Sitharaman on Wednesday wondered if the opposition parties are in favour of black money as they are observing the first anniversary of demonetisation as a black day. On this day last year, Prime Minister Narendra Modi announced demonetisation of Rs 500 and Rs 1,000 notes, which[Read More…]

Rahul clueless about World Bank’s take on Indian economy: BJP

The BJP on Wednesday hit back at Congress Vice President Rahul Gandhi, saying he was exposing himself with his “shallow statements” and knew nothing about the World Bank’s take on India’s economy and the ease of doing business in the country. “Should I presume that he has absolutely no knowledge[Read More…]

GST unleashes ‘tsunami of tax terrorism’ and ‘Jaitley say things are fine’: Rahul Gandhi

Congress vice-president, Rahul Gandhi once again slammed the government and described demonetisation and GST as Prime Minister Narendra Modi’s “double tap” fired to destroy the economy. He also hit out at finance minister, Arun Jaitley for his fiasco to offer a cure to tackle the misery that has led to[Read More…]

PM Modi’s economic advisory council to hold its first meet today

The newly-formed economic advisory council to the Prime Minister (EAC-PM) will hold its first meeting on Wednesday after it held a brainstorming session with stakeholders on Monday. The Council will talk about all matters of developing importance, will engage with a broad spectrum of stakeholders and frame advice accordingly, a[Read More…]

People are tired of Modinomics and Jaitleynomics: Congress

Congress on Friday termed Prime Minister Narendra Modi and Union Finance Minister Arun Jaitley as synonyms of economic mismanagement. Congress spokesperson Randeep Surjewala said, “The truth is people are tired of Modinomics and Jaitleynomics, because they have wrecked India’s economy. Now the economic mismanagement has become synonymous with Prime Minister[Read More…]

Chartered Accountants get a massive GST push

Even as the economy continues to slump after each quarter, there is a particular set of professionals who are rolling in money. According to rough industry estimates, a major jump in revenue has been recorded by the top audit firms in the recent months. “In the last 3 months, the[Read More…]

BJP surfaces as top choice for corporate donors

According to an analysis by the election watch body Association of Democratic Reforms (ADR), business houses handed out a total of 956.77 crores to national parties between 2012-13 and 2015-16 with BJP getting the biggest share at 704.81 crores. The report, which analysed funding received by five national parties- BJP,[Read More…]

Flipkart bags record investment of $2.5billion

In the largest-ever investment in an online Indian company, e-commerce giant Flipkart got an investment of $2.5 billion from a Japanese telecom and internet company. Japanese group SoftBank’s new $93bn Vision Fund has invested $2.5bn in Indian Flipkart – the biggest private investment in the company’s technology sector. The fresh[Read More…]

Direct Tax Collection rises to 19% in April-July

Direct tax collections increased to 19% in the first four months of the current fiscal as demonetisation of higher denomination currency brought in more number of individuals in tax net. Collections of direct taxes, which are made up of personal and corporate taxes, soared to Rs 1.90 lakh crore in[Read More…]

I-T return filings grew by 25% after demonetization: Tax department

According to the tax department, the number of I-T returns filed for the 2016-17 year grew by 25% to 2.82 crores, as increased number of individuals filed their tax returns post demonetization. The growth in ITRs filed by Individuals is 25.3% with over 2.79 crore returns having been received up[Read More…]

Demonetisation squeezed terror funding claims Arun Jaitley

Finance Minister, Arun Jaitley, on Tuesday, said that terror funding has been “squeezed” due to demonetisation. He added that the number of stone throwers in Jammu and Kashmir has gone down in last few months as a result of it. “In 2008 to 2010 we saw thousands of stone pelters[Read More…]

Alarming: Natural disasters occurrence rises from three to 186 in a century

The worsening condition of floods in Assam, West Bengal, Gujarat and other areas of the country is part of a global occurrence that indicates a noticeable increase in frequency and extent of natural disasters in the last six decades or so, shows data. EM-DAT (The International Disaster database) showed that[Read More…]

No more printing of Rs 2000 notes by Reserve Bank of India

It is reported that The Reserve Bank of India stopped printing Rs 2000 notes in March this year. The federal bank is also not likely to print any more Rs 2,000 notes in the current financial year. The RBI, meanwhile, has shifted its focus on printing the newly approved denomination of[Read More…]

About ₹71,941 crore undisclosed income detected in last 3 years

Around 71, 941 crores of undisclosed income have been detected in the last three years after Income Tax (IT) department carried out searches and seizures, informed the Centre to the Supreme Court. The Ministry of Finance has said in an affidavit that from the day after high currency notes were[Read More…]

Only 10% farmer benefit from loan waiver: NITI Aayog

Government think-tank NITI Aayog said that even as states like Maharashtra, Uttar Pradesh and Karnataka announced loan waiver to farmers, it barely helps just 10% of those in need. According to Hindustan Times reports, pitching for “targeted relief rather than blanket loan waivers”, Prof Ramesh Chand, a member at the[Read More…]

Finance Ministry slams fake reports stating churches, mosques are exempt from GST

As GST rolled out this month, rumours were doing rounds on social media stating that the churches and mosques have been exempted from GST. The Finance Ministry made it clear that they are encouraging no religious distinction under the Goods and Service Tax. The rumours which could strike a religious[Read More…]

22 states abolish check posts after GST rollout

Just three days after the GST rollout, as many as 22 states have removed check posts. With the implementation of Goods and Services Tax GST, states such as Delhi, West Bengal and Maharashtra have abolished check-posts; while states, including Assam, Punjab, Himachal Pradesh, and some north-eastern states, are also in[Read More…]

Corruption in politics due to electoral funding mechanism: Arun Jaitley

Finance Minister Arun Jaitley said that cleansing political funding is a “big challenge” but the government is working on the electoral bonds mechanism announced in Budget to end corruption. He further added that people used to say that if corruption is to be annihilated from the country, then the exercise[Read More…]

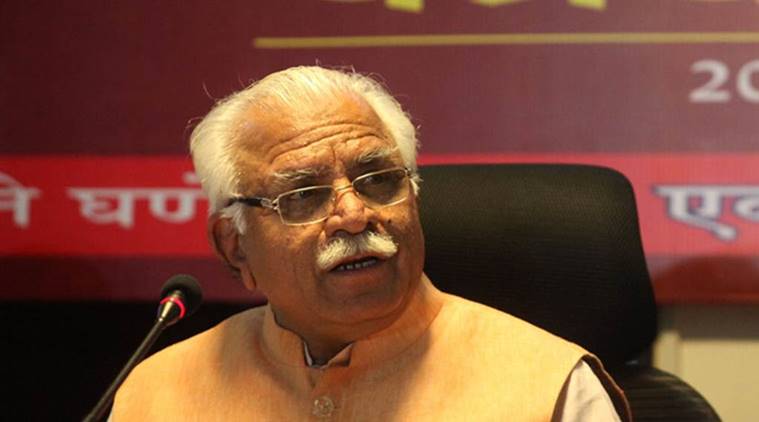

GST will bring “revolutionary” change in the taxation system: Manohar Lal Khattar

While GST is hitting the headlines, on Wednesday, Haryana Chief Minister Manohar Lal Khattar said the implementation of the Goods and Services Tax (GST) is not going to terribly affect the textile business. “Textile has been placed in the slab of 5 per cent under the GST. Presently, there is[Read More…]

PM Modi meets Trump: India and USA to strengthen trade and economic ties

Both PM Modi and US President Donald Trump swore to strengthen the Indo-U.S. economic partnership in a way which will be beneficial for both the countries. They also vowed to work towards solving the existing differences between the two. “On the economic side, the two sides had very productive discussions.[Read More…]