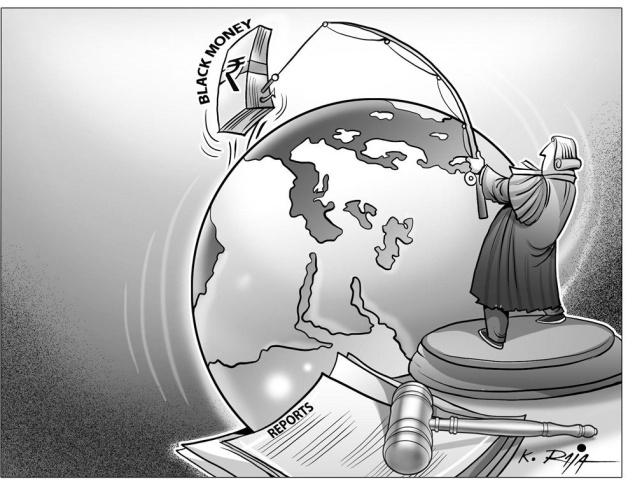

The government has uncovered over ₹13,000 crore black money stashed illegally abroad after it was warned by two separate sources in 2011 and 2013. In its bid to crackdown on tax evaders and illegal offshore bank accounts, this spells success for the Narendra Modi-government.

On a tipoff from the French government in 2011, Indian tax officials have unearthed ₹8,186 crore from 400 citizens, who stashed undeclared income in HSBC, Geneva. France had warned India of 628 cases of illegal transferring of money. 213 were found “not actionable”, meaning they were either empty or owned by non-Indian residents.

The reports filed by the IT department states, “Out of the actionable cases, assessments have been completed in 398 cases, including those settled by the I-T Settlement Commission as well as cases where assessment proceedings have been dropped.”

The money recovered from HSBC, Geneva, is the highest-ever disclosure from offshore banks. It has raised a tax demand of about ₹5,377 crore against such account-holders till March 31, 2016. HSBC declined to comment to the Times of India.

Separately, information from the website of the International Consortium of Investigative Journalists (ICIJ) in 2013, helped officials detect ₹5,000 crore linked to 700 people. Of the 700 cases, the IT department has already filed 55 prosecution complaints in criminal courts. It has alleged these Indians evaded taxes “wilfully”.

Criminal courts have taken cognisance of the complaints, meaning the Enforcement Directorate can now initiate actions under the stringent Prevention of Money Laundering Act (PMLA).

Interestingly, the reports states that many Indians who were named in the recent Panama papers, published by the ICIJ, have already declared black money under the compliance window opened by the government in 2015. The government has, on multiple occasions, threatened severe action against those who don’t declare their assets.