CIBIL is one of the most commonly used credit scoring agencies in India. It’s often used by banks and other lenders to evaluate your credit worthiness. If you’re looking to improve your credit score, or just curious about how it measures up, this guide will show you how to check your CIBIL score online.

What is a CIBIL score?

CIBIL is an acronym for Credit Information Bureau of India Ltd. CIBIL is a non-profit credit information bureau that provides credit profiles and scoring services to consumers, businesses and financial institutions in India.

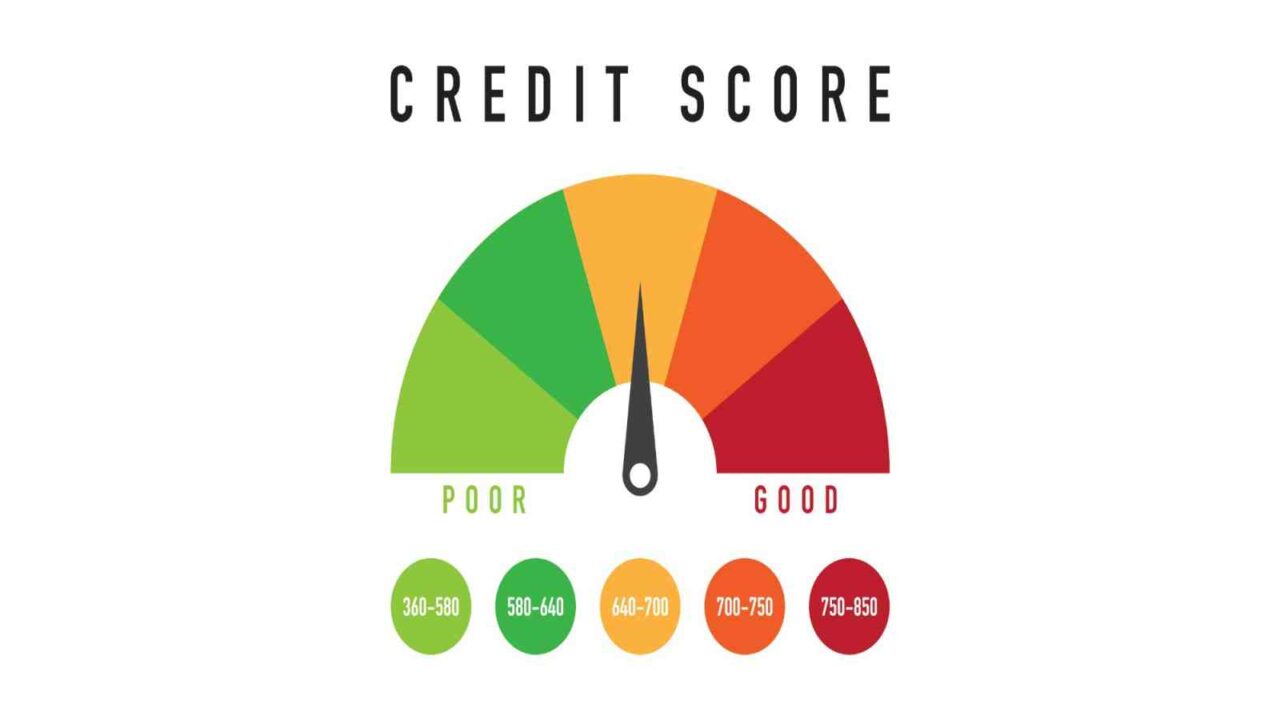

A CIBIL score is a numerical indicator of your creditworthiness that is calculated using a variety of factors, including your credit history and current debt levels. The higher the CIBIL score, the better your credit rating.

To check your CIBIL score online:

- 1) Log into your account at www.cibil.co.in; or

- 2) Access the CIBIL website at www.cibil.com.

- 3) Click on “Credit Score” in the left-hand navigation menu.

- 4) On the “Credit Score” page, click on the “Check My Score” button.

- 5) On the “Check My Score” page, enter your full name, address and date of birth (MM/DD/YYYY).

- 6) Click on the “Submit” button to submit your request.

- 7) Your CIBIL score will be displayed on the “Check My Score” page

How to check your CIBIL score online at ICICI Bank website

If you’re wondering how your CIBIL score is looking, or if you want to make sure that your business meets certain lending requirements, you can check your score online. Here’s a step-by-step guide to doing just that:

- 1. Go to icici.com and sign in.

- 2. Click on “My Business” in the left-hand menu.

- 3. On the “My Business” page, click on “Lending” in the top navigation bar.

- 4. On the “Lending” page, under “Scorecard” click on “Get My Score.”

- 5. You’ll be taken to a page where you can see your current CIBIL score and other important information about your business.

What if I don’t have my CIBIL score?

If you don’t have your CIBIL score, you can still check it online. Here is a step-by-step guide to help you do so.

To check your CIBIL score online, first you will need to go to the CIBIL website and register for an account. After registration, log in to your account and click on “My Scores” from the main menu. On the My Scores page, click on the “Score Details” link under your name. This will take you to the Score Details page, where you will find your CIBIL score and other important information. If you don’t have a CIBIL score, don’t worry! You can still check your eligibility for a mortgage or loan using our eligibility calculator.

What can I do if my CIBIL score is low?

If you’re concerned about your CIBIL score, there are a few things you can do to check it. You can find the CIBIL score on the website of the Indian credit rating agency. Alternatively, you can use one of the free online tools that allow you to check your score.

If your CIBIL score is low, it can mean a few things. Maybe you’re not using all of your available credit and loans, or you might have missed some payments in the past. In either case, there are steps you can take to improve your score and avoid any penalties. Here’s a step-by-step guide to checking your CIBIL score online:

1. Visit the website of the Indian credit rating agency, CIBIL.

2. On the homepage, click on ‘Credit Scores’.

3. On the ‘Credit Scores’ page, click on ‘Get Score’.

4. On the ‘Get Score’ page, enter your full name and ID number (which is usually included on your identity card), and click on ‘Submit’

5. On the ‘Score Details’ page, scroll down to find your CIBIL score.

Conclusion

Checking your CIBIL score is an important step if you are looking to get a loan or credit card. In this article, we have outlined the steps you need to take in order to check your score online and provide some tips on how to improve your score. By following these simple steps, you can ensure that you receive the best possible deal when it comes to securing financing.