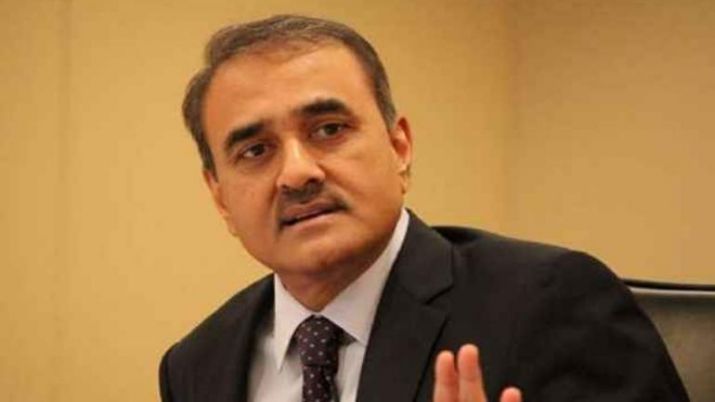

Middle class feels the heat of high petrol, diesel and cooking gas prices and the government should have a relook at the interest rate on savings bank accounts and tax exemption limit, NCP MP Praful Patel said on Monday.

During a discussion on the Appropriation Bill 2022 and the Finance Bill 2022 in the Rajya Sabha, Patel said comparing petrol prices of 2008-09 with that of today was not correct as the situation that time across the globe was different. He said the Ukraine conflict is going to impact all heads of the budget going forward.

”Middle class feels the heat of high petrol prices, diesel prices, cooking gas prices and all the general items on the inflation list which we normally see. Therefore, I feel that at least on the savings account, some kind of balance…for people who go for savings specially, small people. I think we need to have a relook because 3-3.5 per cent interest certainly does not do justice to anybody,” Patel said.

Middle class will be the new poor if govt doesn’t inject cash in economy: Rahul

He said the government’s official inflation figure is more than six per cent and to beat the inflation, interest rates should be increased.

”Again the middle class is the one which is feeling the heat of the (tax) exemption not being increased year-on-year to keep pace with inflation. I feel something needs to be looked at meaningfully at that account also,” he said.

The government in the Finance Bill 2022 has kept the tax exemption limit unchanged.

Patel said the middle class has very little flexibility when it comes to finances.

”They cannot reduce their spending, they cannot increase their earnings. Most of them resort to minor savings. Most of them go to banks. Some people do go to a mutual fund but that’s a very small number. Today banks offer 3-3.5 per cent compared to the official inflation figure of 6 per cent plus. You can imagine very well that an average middle class person cannot beat inflation with the amount of interest. In fact, the income will be reduced to that extent year-on-year,” Patel said.

He said the comparison of current fuel prices with that of 2008-09 is not on the same parameters ”In 2008-09 there was no Ukraine conflict. There were some different situations. At the same time, the rupee was 40 a dollar, right now rupee is around Rs 77 to a dollar. There is going to be a major impact on the finances of the government of India.

“No matter how we are going to portray the numbers because these numbers, while USD 400 billion of exports have been achieved, are very laudable. We must also understand that we are going to face an equally higher deficit because of the higher fuel import bill,” the NCP member said.

He called for giving incentives for industrialisation in smaller towns for job creation.

Samajwadi Party member Vishambhar Prasad Nishad said the price of essential drugs has increased and called for making them unaffordable for the lower rung of the society.

He said while the government has abolished tax on diamond but levies 18 per cent GST on common man’s vehicles like bicycles and called for exemption of GST on them.

BJP member Syed Zafar Islam said the 2022-23 budget is a self-reliant budget and the government is investing in infrastructure which will have multiplier effect on the economy.