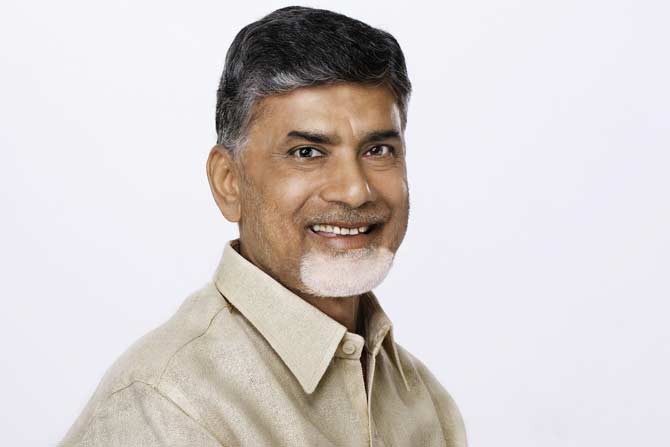

As fuel prices continued the upward spiral, the Andhra Pradesh government Monday announced a reduction of tax on petrol and diesel by Rs 2 a litre. Making the announcement in the state assembly, Chief Minister N Chandrababu Naidu said the Centre earned a huge sum by hiking levies on fuel but did little to reduce the burden on the common man.

The state government is currently levying 31 per cent Value Added Tax plus Rs 4 as additional tax per litre of petrol and diesel. The additional tax component is now being reduced to Rs 2 a litre, a senior official of the Commercial Taxes Department said separately.

Consequently, the price of petrol is expected to come down to Rs 84.71 a litre and diesel Rs 77.98 from Tuesday morning when the tax cut comes into effect.

“Though the state is faced with a deficit budget, we have decided to reduce the tax and ease the burden on people,” the chief minister said.

The state government would have to forego a revenue of Rs 1,120 crore due to the reduction in tax, he said. Making a statement, Naidu said the Centre pocketed a staggering Rs 23 lakh crore in the last four-and-a-half years by way of various duties and dividends but failed to take steps to mitigate the burden on common people as petrol and diesel prices touched unprecedented levels.

“The price of crude oil fell from a high of USD 105.52 per barrel in 2013-14 to USD 72.23 now but the price of a liter of petrol shot up from Rs 49.60 in 2014 to Rs 86.71 now.

The price of diesel rose from Rs 62.98 to Rs 79.98 during the same period,” he said. Instead of reducing petrol and diesel prices following the fall in crude oil rates, the Centre increased additional taxes and cess.

“Excise duty on diesel was increased to Rs 17.33 a litre in September 2018 from Rs 3.56 in June 2014. Excise duty on petrol shot up from Rs 9.48 a litre to Rs 19.48 during the period. In addition, infrastructure cess is being levied at Rs 7 (per litre) on petrol and Rs 8 on diesel,” the chief minister said.

The Centre earned Rs 10 lakh crore in the form of excise duty and an additional Rs 13 lakh crore as cess and dividends in the last four-and-a-half years by this “grave anti-people” act, he said.

“Living standards are deteriorating because of the hike in petroleum prices and the consequent rise in prices of essential commodities.

The Centre should act responsibly and reduce excise duty and cess to provide immediate relief to the poor and middle-class people,” he said. The House also adopted a resolution in support of the demand for bringing down excise duty and in fracture cess on fuel.