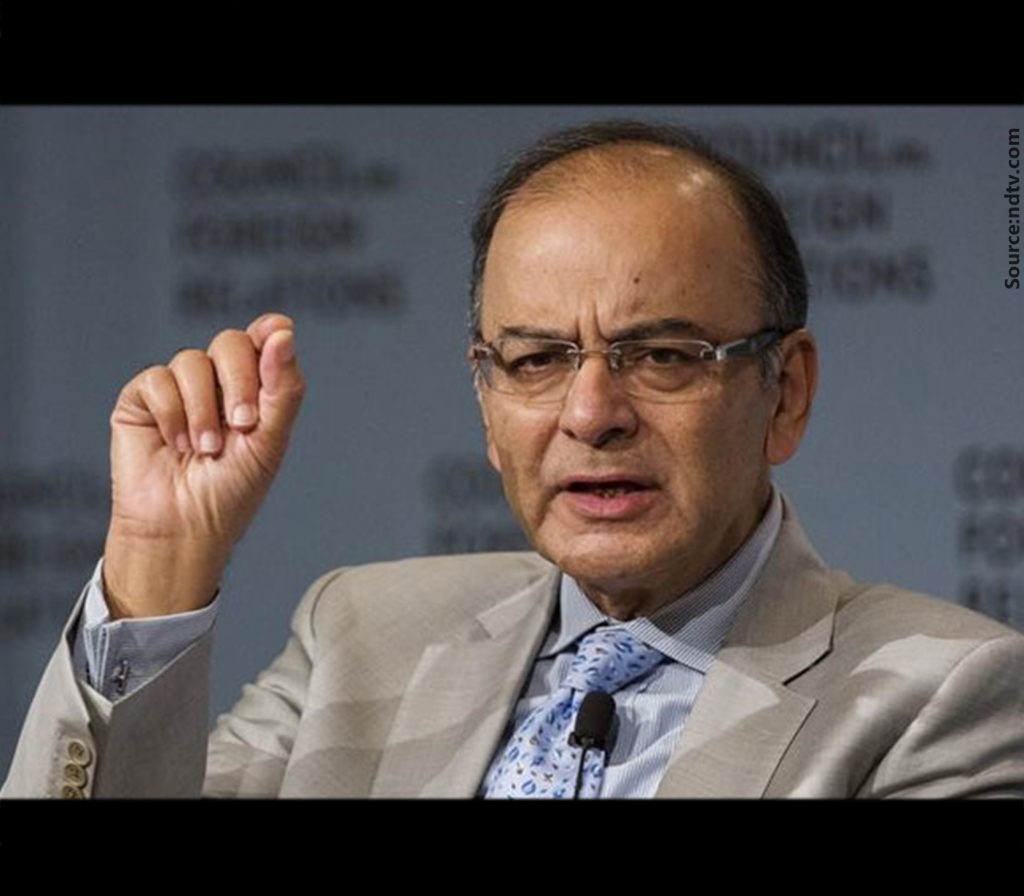

Finance Minister Arun Jaitley released a postage stamp to commemorate 140 years of India’s first stock exchange, the BSE today in Delhi.

Addressing the gathering Jaitley said that BSE was formed as an immediate need for the Indian economy and was an important step towards industrialization. He further added that impact created by BSE in all these years is nothing less than a revolution by saying, “I think this is the greatest revolution that took place to raise capital in the economy. The very idea of a company having a distinct identity enrolled the prospects of an opportunity to investors to choose and invest as per their needs.”

He also gave hope of increased foreign investments in India, by saying that despite the good growth rate of economy owing to the FDI policy, the best of the private sector is yet to come and hinted towards amendments in BSE by saying, “It is important to make necessary changes and amendments for India’s oldest stock exchange to prosper and keep the economy going.”

Apart from this BSE managing director and CEO Ashishkumar Chauhan also unveiled plans of launching a commodity derivative segment which will allow trading in metals. In order to give shape to this step, he confirmed that BSE has approached Securities and Exchange Board of India (Sebi) for its approval in the matter. Speaking at the gathering Chauhan said, “BSE plans to set up a commodity derivative segment as soon as approvals are in place. It would consist of non-agricultural commodities like metal, oil and gas.” He also announced the recent approval acquired by the BSE for setting up of an international exchange in Gujarat’s GIFT City. He said, “We will apply to regulator Sebi. This is first time that an international finance zone is set up and we plan to offer all asset classes which will include equity derivative, currency derivative, interest rate derivative, and international and domestic commodities in the international exchange.”

The new exchange will also help global companies raise finance from other overseas investors.

Chauhan also spoke about BSE’s ambition of being more than just an equity trading platform and become an “investment bourse” of every type of asset class. He also cleared speculations over the creation of a separate subsidiary to start commodity trading, saying that it wasn’t required now, owing to the recent merger of the Sebi and watchdog Forward Market Commission.

“As and when that (merger) process is complete, our members can trade in commodities. Earlier, you had to open a separate subsidiary to become member of commodity exchange. Now they are allowing us to trade as part of BSE as and when the approvals come,” Chauhan said.

At present, there are two major national and six regional bourses which offer commodity futures trading in the country.