Global Stock Markets Experience Incremental Rise Following Australian Rate Hike: According to the CME FedWatch tool, markets have priced in an 82% chance of the Fed pausing its accelerated rate hike cycle, a significant increase from the 36% chance a week ago. The dollar index, which measures the greenback relative to the major global currencies, inched up 0.17 per cent.

World equities inched higher on Tuesday as investors pondered the sustainability of the recent stock market rally, while Treasury yields inched higher as traders reduced wagers that U.S. rate cuts are imminent in light of persistent inflationary pressures. Monday marked a near 10-month high for the S&P 500 on Wall Street, which was profitable. The S&P 500 index increased by 0.1%, while the Dow Jones Industrial Average remained relatively unchanged and the Nasdaq Composite Index increased by 0.25 %.

The pan-European STOXX 600 index increased by 0.38 percent, while MSCI’s broadest index of Asia-Pacific shares excluding Japan remained relatively unchanged. Consequently, the MSCI’s broadest index of global equities rose 0.21 percent. With all main stock markets in the black, investors may believe that stocks will continue to rise. Nonetheless, some analysts cautioned investors against overconfidence.

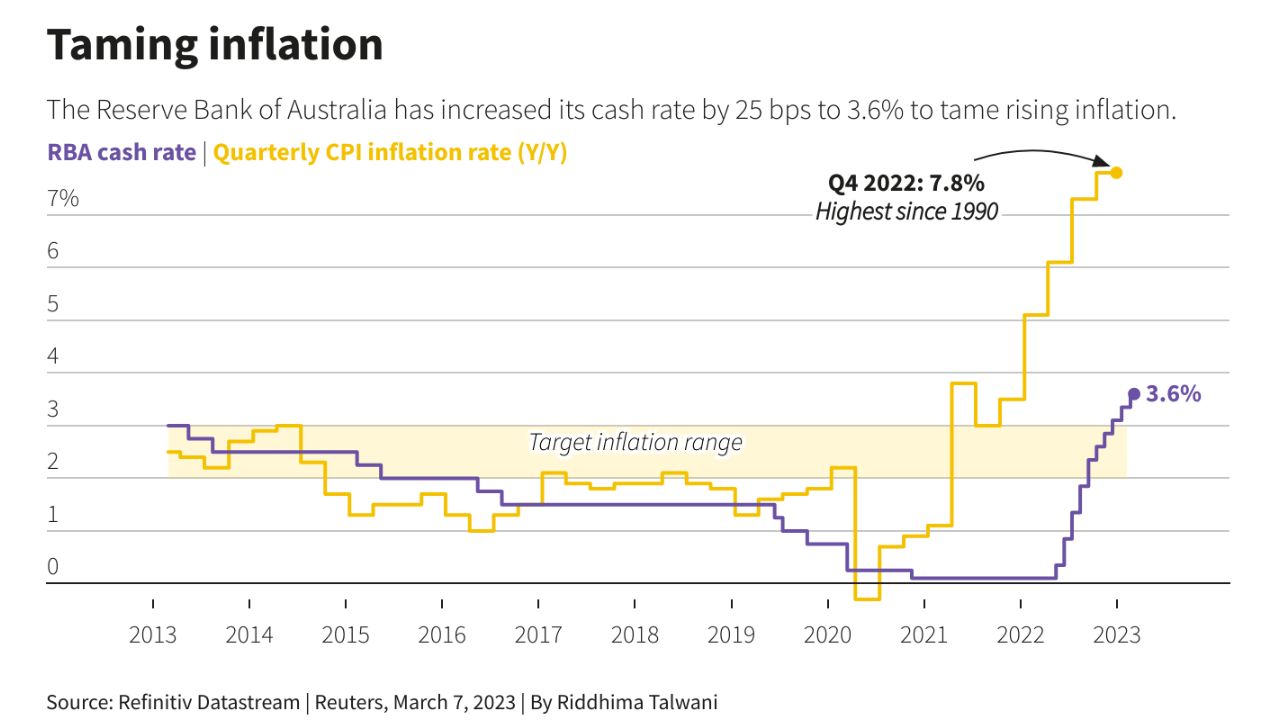

Australia’s central bank raised interest rates unexpectedly on Tuesday, and while investors largely expect the Federal Reserve to refrain from raising rates next week, some analysts warn that additional rate increases by the Fed are likely. Bank of America Securities analysts stated, “We would be cautious not to give in to FOMO (fear of missing out) completely.”

Global Stock Markets Experience Incremental Rise Following Australian Rate Hike

“A skipped hike is not a pause, inflation still handcuffs the Fed (no high-strike Fed put), and a U.S. recession remains on the horizon.” The yield on two-year Treasury notes, which tends to move in tandem with interest rate forecasts, increased to 4.5225%, while the yield on 10-year Treasury notes inched up to 3.7043%.

Government bond yields, a proxy for borrowing rates, decreased earlier after a survey by the European Central Bank (ECB) revealed that euro zone consumers’ inflation expectations had decreased. British retail sales growth also declined to a seven-month low as rising food prices prompted consumers to cut back on non-essential purchases, in contrast to overnight developments in Australia.

Australia’s central bank raised interest rates by a quarter-point to 4.1%, the highest level in 11 years, and warned that further increases may be necessary to bring inflation under control. This pushed the Australian dollar higher and set the stage for a slew of key rate decisions in the coming weeks, beginning with Canada on Wednesday, which could squeeze in another raise, according to James Rossiter, senior global strategist at TD Securities.

The last few months have been dominated by the banking crises and the U.S. debt ceiling debate, but now the focus has returned to the macro dynamics that drive central banks and where their terminal interest rates will be. “The problem is that inflation is not behaving as expected, and central banks are really struggling with this,” he continued.

Next week, the Federal Reserve, the European Central Bank, and the Bank of Japan all conduct meetings. According to the CME FedWatch tool, markets have priced in an 82% chance of the Fed pausing its accelerated rate hike cycle, a significant increase from the 36% chance a week ago.

Global Stock Markets

The dollar index, which measures the greenback relative to the major global currencies, inched up 0.17 percent. The market was lead by the 0.7% increase in the Australian dollar following the Reserve Bank of Australia’s overnight surprise. By midday in New York, the Australian dollar had risen 0.86% to $0.6672.

The euro fell 0.26 percent to $1.0684, while the yen was unchanged at 139.675 per dollar and sterling was unchanged at $1.24230. CRYPTO CRACKDOWN

The U.S. Securities and Exchange Commission filed a lawsuit against the largest U.S. crypto asset trading platform, Coinbase, a day after filing a lawsuit against crypto exchange Binance. Bitcoin managed to maintain its position, increasing 2.8% to $26,446.

Nansen, a data firm, estimated that approximately $790 million had been withdrawn from Binance and its U.S. affiliate in the preceding twenty-four hours. Oil prices declined after surging on Monday following the announcement that the world’s largest exporter, Saudi Arabia, would further reduce output. Brent fell 0.38 percent to $76.43, while U.S. crude fell 0.33 percent to $71.91.