The gross bad loans of the banks have declined to a little over Rs 8 lakh crore by end of the September 2021 quarter from over Rs 9.33 lakh crore at the end of March 2019, the government informed in Parliament on Monday.

Of this, the share of public sector banks (PSBs) in bad loans proportion has also declined 72 per cent against nearly 80 per cent.

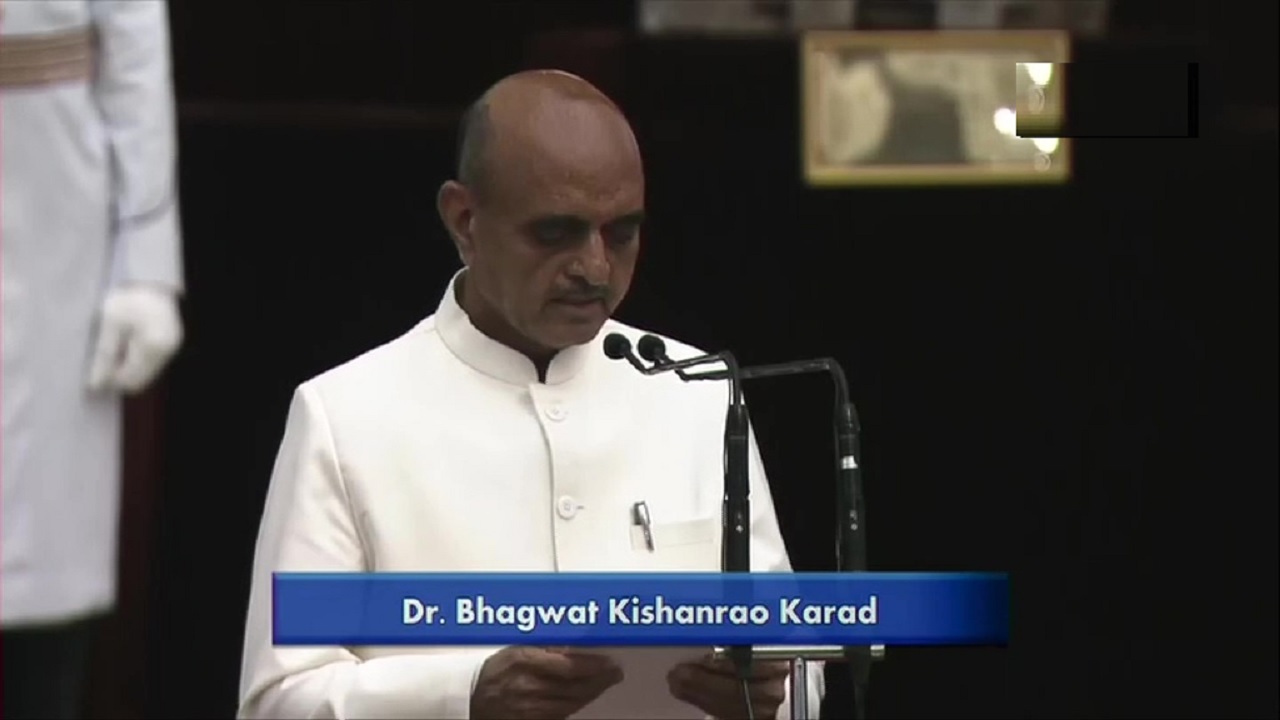

Citing Reserve Bank of India’s (RBI) data on global operations of scheduled commercial banks, Minister of State for Finance Bhagwat Karad in a reply to the Lok Sabha said the banks’ gross non-performing assets (GNPAs) have declined from Rs 9,33,779 crore (GNPA ratio of 9.07 per cent) as on March 31, 2019, to Rs 8,00,463 crore (6.93 per cent) as of September 30, 2021.

GNPAs of public sector banks as a proportion to that of scheduled commercial banks (SCBs) have decreased from 79.2 per cent as on March 31, 2019, to 72.3 per cent as on September 9, 2021, the minister said.

However, gross NPAs of private sector banks as a proportion of that of SCBs have increased from 19.4 per cent to 24.9 per cent during this period, Karad said.

Gross NPAs of deposit-taking NBFCs and non-deposit taking systemically important NBFCs stood at Rs 1,91,413 crore (GNPA ratio of 6.87 per cent) at the end of September 2021.

Responding to a question on steps taken by the government to tackle the issue of credit penetration, Karad said several initiatives have been taken such as opening 44.51 crore accounts under the Pradhan Mantri Jan Dhan Yojana (PMJDY), overdraft facility of limit up to Rs 10,000 to eligible PMJDY account holders, and PM SVANidhi to help poor street vendors impacted by the COVID-19 pandemic.

The PM Street Vendor’s Atma Nirbhar Nidhi (PM SVANidhi) was aimed to resume their livelihood activities. It enabled 32.69 lakh street vendors to access credit amounting to Rs 3,364 crore till January 31, 2022, the minister said.

Other schemes include enhanced access to credit under Deendayal Antodaya Yojana-National Rural Livelihoods Mission, bank credit to NBFCs (excluding microfinance institutions) to give loans under priority sector lending, digitisation of loan process to increase the reach of institutional credit, and credit outreach programmes run by banks.

Loans worth Rs 94,063 crore has been sanctioned up to November 26, 2021, through special camps across the country, he said.