New Delhi: Imagine losing an amount worth your monthly salary to an unknown imposter whose ‘position’ ranks at the top of Google ads that flashes at your screen when you search for your query “google pay customer care number”. There are websites who pose themselves as help centres to “help” you out of your online cash wallet troubles and instead extract money from these once you provide them with the details.

In an interesting case that surfaced from New Ashok Nagar in Delhi, Mahendra Kushawaha, a resident of the area, lost his hard-earned money to an online-fraud website. Mahendra, a man of modest means, who is the sole worker supporting the family of seven, lost Rs. 20,000/- while trying to trace an earlier transaction he made through the Google Pay mobile app.

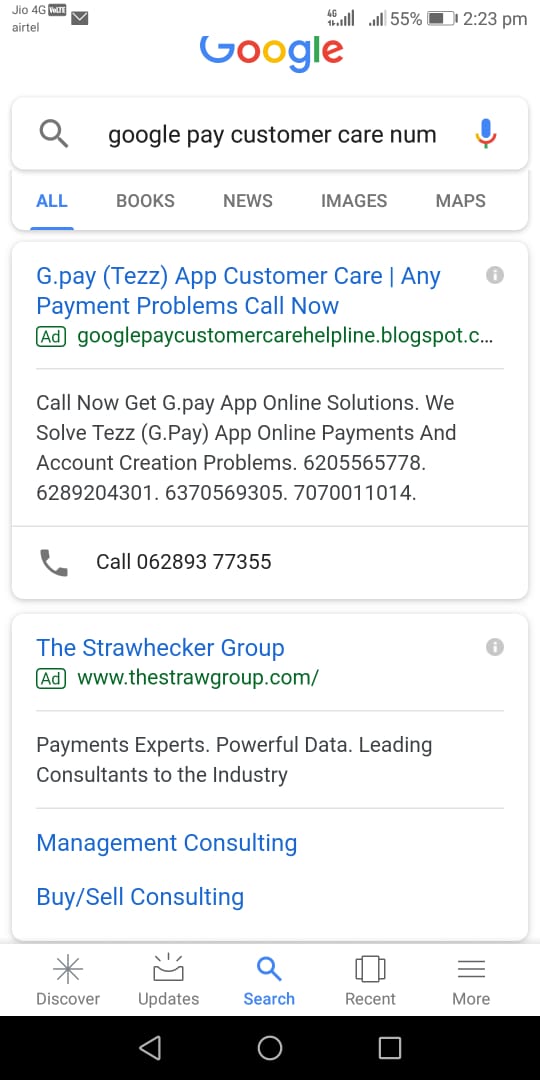

While sharing his ordeal with Newsd.in, Kushawaha said that it all started after he found it difficult to trace Rs 200 which he had transferred to his friend via the Google Pay mobile application. This, he said, prompted him to call the customer care helpline of the App. As most netizens, his first instinct was to enter his query into the Google search-box and look for results related to “google pay customer care number”, which according to the screenshot shared by him can be seen as being placed as an Ad.

Kushawaha claims that after seeing the phone number on Google, he made a call. After dialling the number, he explains that the phone was immediately disconnected. Moments later, Kushawaha received a call from a different number.

About the conversation that took place between Kushawaha and the alleged scammer, the former said that he was asked to download a mobile application called, “Download AnyDesk Remote Access”.

Following the phone call, Mahendra told Newsd that when they said they will resolve his issue, he trusted them to do it. Upon downloading the said mobile application suggested by the alleged scammer, the accused received access to Kushawaha’s phone.

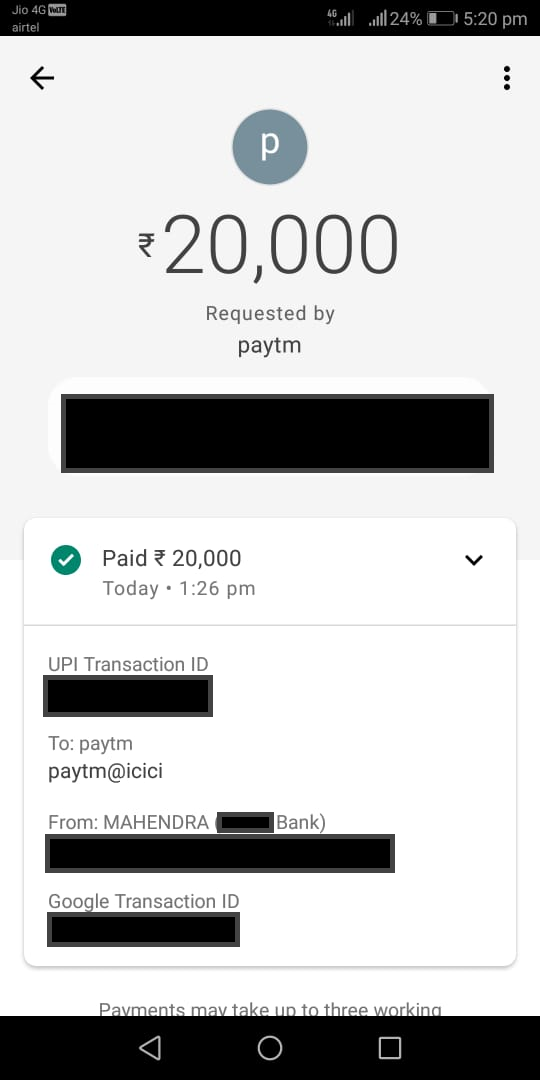

According to Kushawaha, the ‘helper’ attempted taking money from Kushawaha’s bank account through his PayTM, thrice. Failing in successive attempts, the accused then successfully transferred Rs 20,000 from Kushwaha’s account to an account that reads ‘paytm@icici’ via UPI using Google Pay app.

Following the incident a co-worker of Kushawaha tried to contact the scamster’s number, apparently, his call was also cancelled and a similar conversation the Kushawaha had with a scamster followed.

AnyDesk Press Office on Tuesday (19 February) mailed Newsd, the following statement.

We deny that our application steals money from user accounts and we object to advice saying not to download our software. This accusation is completely false and harms our company’s great reputation.

We are deeply sorry for all the users who were victims of this fraud scheme, but in this case our remote access software was used by fraudsters to take advantage of people willing to provide access to their computer to unknown individuals. This same situation could be repeated with any other remote access software.

AnyDesk provides remote access from one device to another. However, this access needs to be authorized on the other side. There is no danger in using AnyDesk, which employs bank-level security protocols.

In light of these revelations, we have informed users of AnyDesk and other remote access applications to only provide access to their devices to those individuals they actually know.

We at AnyDesk always work in close cooperation with law enforcement authorities to counter abuse.

We have asked Google to comment on the issue and are currently waiting for a response from their side.

The Reserve Bank of India on Thursday (February 14) cautioned banks of the exactly similar scam which has the potential of erasing bank balance via AnyDesk app and the UPI platform.