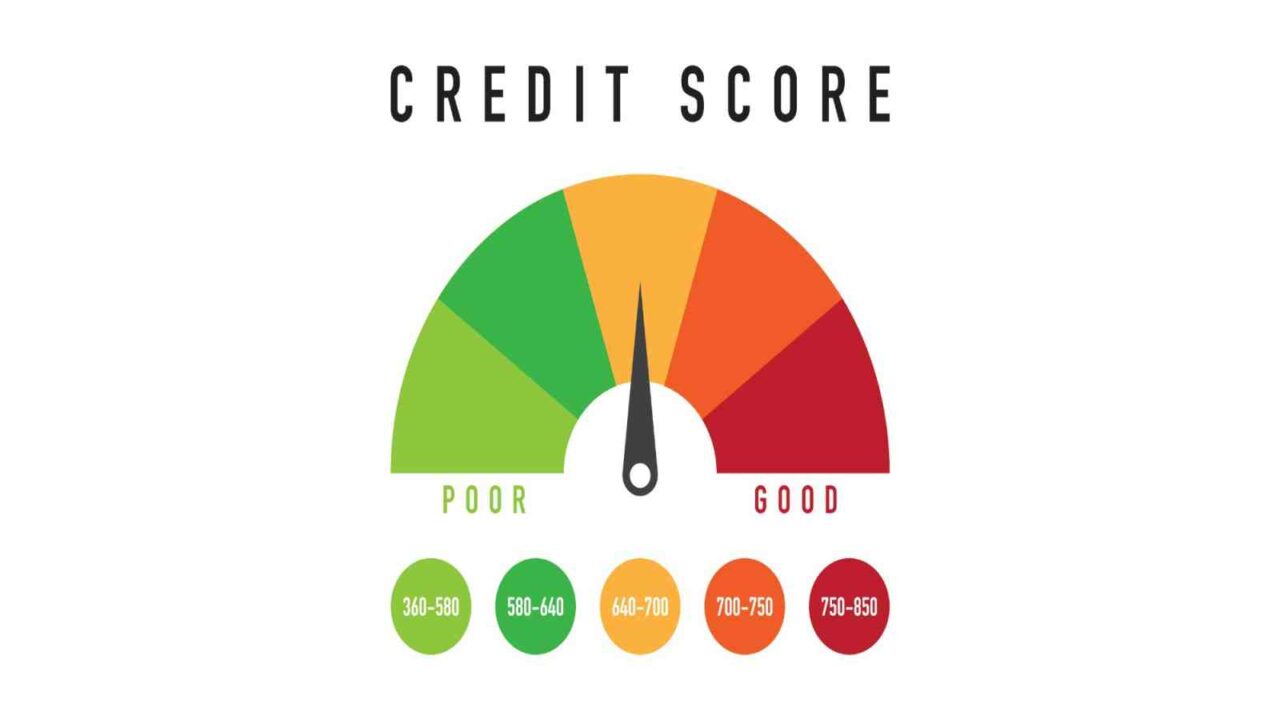

Your credit score or CIBIL score is an important factor that determines your loan approval. It shows your creditworthiness to the lender. However, if you have settled a loan recently, it might have impacted your CIBIL score. Thankfully, you can take steps to improve your credit score and gain financial stability again. How? Read on to know!

What is the Effect of Loan Settlement on Your Credit Score?

Settlement of your loan means you have negotiated with the lender to pay off a portion of your overall debt, usually less than the full amount you owned. While it provides immediate relief from financial stress, it can negatively impact your CIBIL score.

The settlement of the loan would be visible on your credit report for up to seven years and indicate that you were unable to fulfil your original repayment terms.

6 Steps to Improve CIBIL Score After Settlement

- Frequently Check Your Credit Report

Review your credit report frequently. look for any errors or discrepancies that can affect your credit score. In case you find any, raise a dispute immediately and get it corrected.

- Pay Your Bills on Time

Consistently paying your bills on time is one of the most effective ways in which you can improve your CIBIL score. You can also set up automatic payments or reminders to make sure you don’t miss any due dates.

- Limit Your Credit Utilisation

It is always advised to keep your credit utilisation to 30%. Using too much of your credit shows the lender that you are totally dependent on your credit, which can impact your chances of getting new credit.

- Diversify Your Credit Mix

Consider having a mix of credit accounts, such as term loans and credit cards, which can influence your CIBIL score positively. If you have relied on one type of credit, consider diversifying it by opening new accounts. Also, avoid applying for multiple credits simultaneously.

- Build a Positive Payment History

Build a responsible credit history by making timely payments on your credit accounts, which includes loans, Credit cards, and utility bills. This will help you build a positive and good credit score.

- Limit New Credit Inquiries

Whenever you apply for a new credit, it has to go through a hard inquiry which gets recorded on your credit report. A hard inquiry can temporarily lower your CIBIL score. So, limit new credit inquiries by only applying for credit when it is a must.

To Conclude

Settling a loan can temporarily impact your CIBIL score, but it is not the end of your financial health. By implementing proactive strategies to improve your creditworthiness, you can gradually rebuild your CIBIL score after loan settlement. Remember that improving your credit score will not happen in one day, it takes time and patience. But it is possible with diligence and responsible financial management.