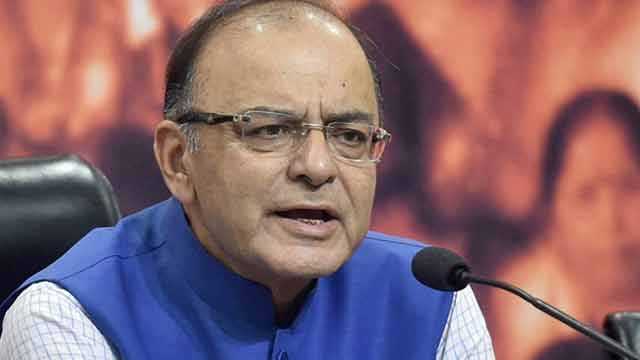

After the 16th GST Council meet, Finance Minister, Arun Jaitley announced the revised rates of 66 items as against representations received for 133 items.

After a press meet, Arun Jaitley addressed to the media and said that the new revisions have been made after getting feedback from the industry players.

He said, ” after considering the recommendations, the GST Council has reduced the tax level in 66 out of 133 items”.

The new reductions are based on mainly two principles: one-maintaining equivalence and second, the change in the utilisation behaviour.

Read more: Tax rates of 66 items revived under GST

Now, traders, manufacturers and restaurants with a turnover of up to Rs 75 lakh can avail themselves of the composition scheme. Earlier the limit was set at Rs 50 lakh.

However, the council is again scheduled to meet on June 18 to take up lottery taxes and e-way bill. Also, GST on movie tickets below Rs 100 has been cut to 18% while those above Rs 100 will be taxed at 28%.

As per ET, some of the revised tax items that Finance Minister highlighted were:

Cashew revised from 12% to5%

Packaged food, including some fruits and vegetables, pickles, toppings, instant food, sauces revised from 18% to 12%

Agarbatti revised from 12% to 5%

Dental wax revised from 28% to 8%

Insulin revised from 12% to 5%

Plastic beads revised from 28% to 18%

Plastic tarpaulin revised from 28% to 18%

School bags revised from 28% to 18%

Exercise books revised from 18% to 12%

Pre-cast concrete pipes revised from 28% to 18%

Cutlery revised from 18% to 12%

Tractor components revised from 28% to 18%