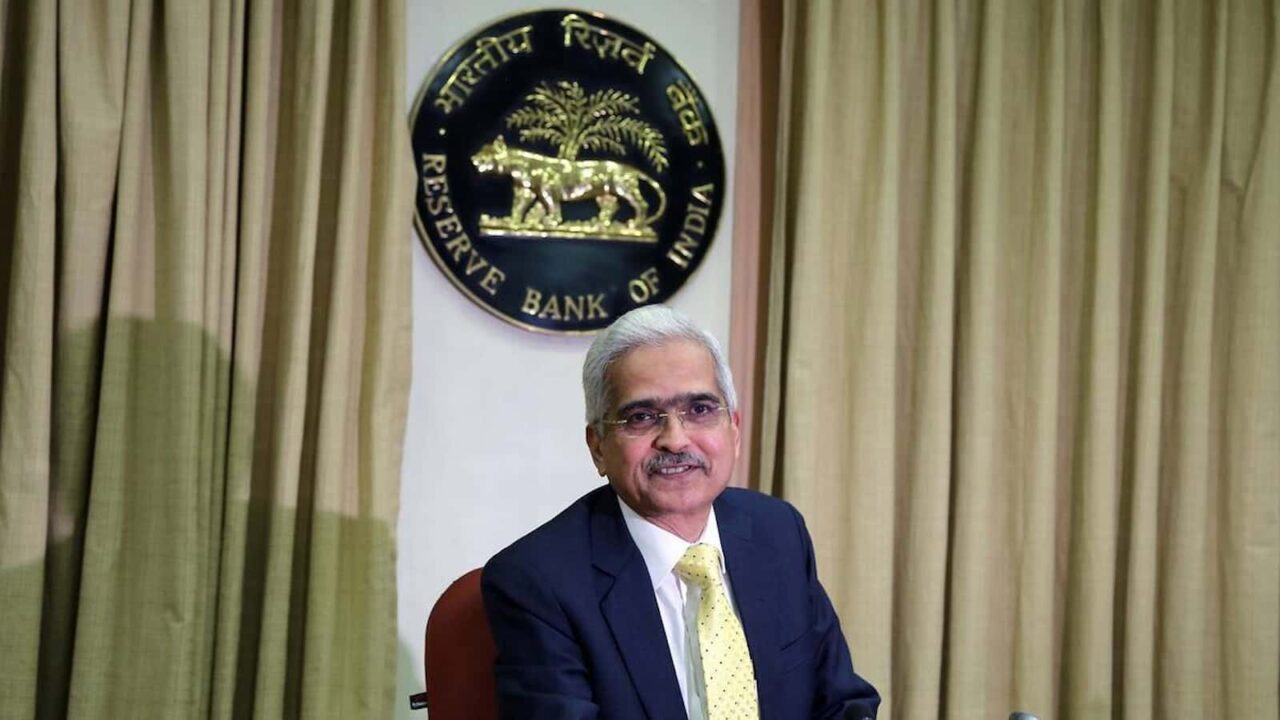

RBI MPC meet: Anticipations are high that the Reserve Bank of India (RBI), in anticipation of its three-day Monetary Policy Committee (MPC) meeting commencing on December 6, will maintain the repo rate at its current level of 6.5%.

The inflation-subdued trend and an acceleration in GDP growth during the July–September quarter are anticipated to prompt the MPC to maintain interest rates at their current level for the fifth consecutive time.

RBI keeps overall 2023-24 growth and inflation forecast unchanged

The RBI is reportedly scheduled to make the following announcement on December 8:

According to Parijat Agrawal, Head – Of fixed Income at Union Asset Management Company, the organization is commencing the policy with a favorable external environment and an enhanced domestic macro environment. The GDP for the second quarter of fiscal year 24 exceeded expectations; consequently, we anticipate the RBI to revise its estimates upwards for the entire year. Since its apex, the US 10-year has undergone a significant correction by incoming data and the central bank’s narrative.

Oil price concerns have diminished and have hovered near $80 for the past few weeks. We anticipate that while the MPC will prioritize bringing inflation to the 4% target, it will maintain a pause on interest rates and posture. The markets will be highly interested in Open Market Operations (OMO) and advice on systemic liquidity. Additionally, further details regarding the retail and unsecured credit landscape might be disclosed.

“With CPI inflation moderating to 4.87% YoY in October ’23 (and core CPI inflation to 4.5% YoY), we expect the RBI to maintain the policy repo rate at its next MPC meeting,” said Prasenjit Basu, chief economist at ICICI Securities. As an anticipation of additional reductions in inflationary pressure, the MPC is probable to transition from its previous position of “withdrawal of accommodation” to a neutral policy stance.

“The RBI’s ‘State of the Economy’ monthly bulletin for November acknowledged the robust festival-driven demand and positive consumer sentiment,” said Umesh Revankar, executive vice chairman of Shriram Finance. The article also reported that inflation had decreased to 4.7% in October. Hope has been reignited for a return to the declining rates regime in light of these statements.

To control system liquidity, the RBI recently increased risk weights on consumer credit, credit card receivables, and NBFC exposure by 25 percentage points to a maximum of 125%. It is abundantly evident that the financial regulator is not in the least bit relaxed regarding inflation, and rightly so. Nonetheless, these measures do affect MSME on-lending by NBFCs, temporarily halting credit growth. Although the recent quarterly inflation figures have been positive, we concur with the Reserve Bank of India’s assessment that our economy is not yet salvageable. As a result, we anticipate that the MPC will maintain the repo rate at 6.5 percent to stabilize inflation around the 4 percent medium-term target through liquidity management. Additionally, we do not foresee any reductions in interest rates until the commencement of the subsequent fiscal year.

Madhusudan Sharma, Executive Director, of Bharat Housing Network, an infrastructure and housing credit platform for affordable housing, stated, “As inflation remains under control, the Reserve Bank of India (RBI) is likely to maintain interest rates unchanged at its upcoming monetary policy review.” The central bank would prefer to assist in the burgeoning GDP growth. Despite this optimistic outlook, we expect robust demand for home loans across all segments to continue. Additionally, anticipated supportive policy measures, especially in rural and semi-urban regions, will stimulate the sector.