On the supposed ground of increased input costs following GST, liquor prices in Bengaluru stores rise by 13.28%. The liquor itself does not come under the new taxation regime and any increase in costs is not to be passed on by the manufacturer. Though, since Saturday, liquor stores have been[Read More…]

Tag: GST

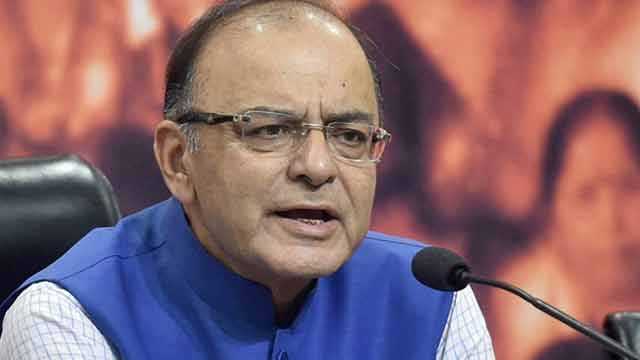

Corruption in politics due to electoral funding mechanism: Arun Jaitley

Finance Minister Arun Jaitley said that cleansing political funding is a “big challenge” but the government is working on the electoral bonds mechanism announced in Budget to end corruption. He further added that people used to say that if corruption is to be annihilated from the country, then the exercise[Read More…]

GST effect: Here’s list of daily items that have become cheaper and costlier

Touted as the biggest tax reform, the Goods and Services Tax, has been finally launched after years of debate. However, common people are still naive about how this change is going to affect them in their daily lives. Thus, here we bring you a list of goods and services that[Read More…]

GST launch: PM Modi calls it ‘Good and Simple Tax’

Prime Minister Narendra Modi launched Goods and Services Tax (GST) before addressing Member of Parliaments in the historic Central Hall in presence of President and other noted dignitaries. GST is a Good and Simple Tax, PM said just before launching the Goods and Services Tax. Finance Minister Arun Jaitley said,[Read More…]

Trade in Uttar Pradesh to remain shut opposing GST roll out

As the government is all set to roll out Goods and Services Tax (GST) from June 30 midnight, traders in Uttar Pradesh are not happy with the decision. In Ghaziabad, opposing the GST implementation, traders will remain dysfunctional on Saturday demanding amendments to certain provisions of the GST before the[Read More…]

Ahead of its rollout, BJP Minister unaware of what GST stands for

As the Goods and Services Tax(GST) is all set to rollout on Friday midnight, a minister of the very Bhartiya Janata Party(BJP) is unable to even spell out the full-form of GST. In a talk with the local businessmen, Ramapati Shastri, Minister of Social Welfare and Minister of SC &[Read More…]

Congress to boycott midnight GST bash on June 30

The Congress will boycott the launch of the Good and Services Tax (GST) on June 30 midnight during a special session of Parliament. “The Congress has decided not to attend GST midnight session on June 30 in Parliament,” said Congress’ Satyavrat Chaturvedi, reported HT. After this boycott decision, Congress has[Read More…]

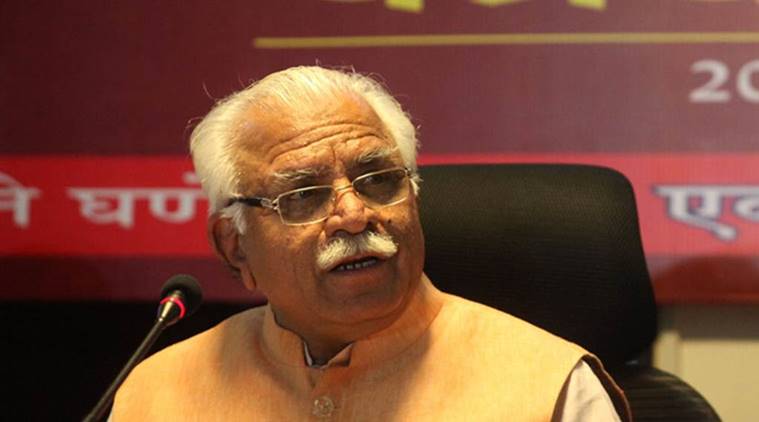

GST will bring “revolutionary” change in the taxation system: Manohar Lal Khattar

While GST is hitting the headlines, on Wednesday, Haryana Chief Minister Manohar Lal Khattar said the implementation of the Goods and Services Tax (GST) is not going to terribly affect the textile business. “Textile has been placed in the slab of 5 per cent under the GST. Presently, there is[Read More…]

GST to reduce tax burden: Urjit Patel

On Thursday, the Reserve Bank Governor Urjit Patel said that to be implemented goods and services tax (GST) will not only create a national market but will also broaden the tax base which in turn will lower the overall taxes in the long-term. “The prudent point is that GST itself[Read More…]

Congress urges Big B to withdraw from GST promotion

Congress leader Sanjay Nirupam has urged the Bollywood megastar Amitabh Bachchan to withdraw from GST promotion to avoid getting targeted by traders later. Earlier, the government roped in Mr Bachchan to promote Goods and Services Tax (GST), which is set to roll out from July 1. According to Times Now, the Central[Read More…]

Tax rates of 66 items revised under GST

After the 16th GST Council meet, Finance Minister, Arun Jaitley announced the revised rates of 66 items as against representations received for 133 items. After a press meet, Arun Jaitley addressed to the media and said that the new revisions have been made after getting feedback from the industry players. He[Read More…]

Haryana traders to protest against GST on clothes

Over 450 retail and wholesale cloth merchants in Haryana are against the GST proposed on clothes by the government. According to the merchants, the new tax slab on clothes will escalate the cost of clothes for customers and they fear a slowdown in the cloth trade after the imposition of[Read More…]

No tax waiver on films from July 1, says Haryana government

With the roll-out of the Goods and Service Tax (GST) regime from July 1, the tax waiver to films by the Haryana government will be a thing of past. However, if the state waives tax on a movie, it will not only lose its own share of the GST, but will[Read More…]

PM Modi reviews GST progress ahead of July 1 roll-out

On Monday, Prime Minister Narendra Modi, in view of the Goods and Services Tax (GST) said that the roll-out of the new indirect tax regime from July 1 will be a turning point for the economy. Notably, this was the first PM’s review on the freshly finalised rates by the[Read More…]

GST rates for gold and textiles fixed; roll out from 1st July

A meeting of the 15th Goods and Services Tax (GST) Council began at the Vigyan Bhavan, Delhi, on Saturday to finalise the taxes to be levied on Six commodities, including, gold, textiles, footwear, agriculture, handloom and handicrafts. Here are the highlights: Rate for gold, gems and jewellery fixed at 3%[Read More…]

‘We have restored credibility of the economy’, says Arun Jaitley

On completion of NDA government’s three years in power, Finance Minister Arun Jaitley briefed the media in New Delhi on Thursday. He claimed to have “restored the credibility of the economy”, adding that, “We have shown decisiveness, even the ability to take difficult decisions.” He said the government has taken[Read More…]

Hotels in South India to observe bandh to protest against GST rates

The hotels in South India have decided to observe a day’s bandh on May 30 in a protest as the GST rates declared by the Union Government will cripple the hotel industry and place an unbearable burden on the common man said T Satyanarayana, the general secretary of the AP[Read More…]

GST Effect: Premium cars become more enticing

Goods and Service Tax (GST) is in its final stages of revision before it is implemented countrywide on July 1, 2017. While GST has rendered the car as a luxury commodity, its recent release of tax structure has had a mixed bag of news for the automotive industry. After a[Read More…]

Impact of GST on car prices in India

Should you buy a new car now Or after GST is rolled out? India is finally on the verge of having a simplified taxation system. But before the Goods & Service Tax (GST) comes into effect on July 1, 2017 (proposed), and replaces multiple state and central taxes with a[Read More…]

83 services exempted from GST

The Goods and Services (GST) Council agreed on the fitment of almost every commodity in the various tax slabs under the new tax regime, which will be rolled out on July 1. Milk, cereals (unpackaged and unbranded), and jaggery will be exempt from GST, while sugar, tea, coffee (except instant),[Read More…]

GST rates of 1,211 items decided; food grains exempted from levy

The Goods and service council on Thursday decided the GST rates for 1,211 items, a majority kept at 18%, though the rates on gold and beedi remained undecided. The Centre also chose to lower the incidence of tax on mass-use items to ensure that prices come down in the new[Read More…]

Bihar Assembly approves GST Bill

Make sanitary napkins tax-free, LahukaLagaan campaign trends on Twitter

A campaign which asks government to make sanitary napkins tax-free has been trending on Twitter. SheSays, a non-profitorganisation, started the campaign with #LahukaLagaan. The campaign urges finance minister Arun Jaitley to exempt the tax on sanitary napkins by making it a non-luxury item under the GST. Legal representations have been[Read More…]

GST bills in Rajya Sabha, Opposition urges for a mechanism to avoid the harassment by tax authorities

The Rajya Sabha on Wednesday took up the four bills related to the GST. Opposition questioned the government’s preparedness to implement the indirect tax regime and urged for a mechanism to insulate taxpayers from harassment by tax authorities. Deputy Leader of Congress Anand Sharma said, “It is important that as[Read More…]

Govt may table GST Bills in Parliament on Monday

The government is likely to table supplementary goods and services tax legislations in Parliament on Monday. “C-GST, I-GST, UT-GST and the compensation law are likely to be introduced in the Lok Sabha on Monday and could be taken up for discussion as early as March 28,” PTI reported, quoting sources.[Read More…]